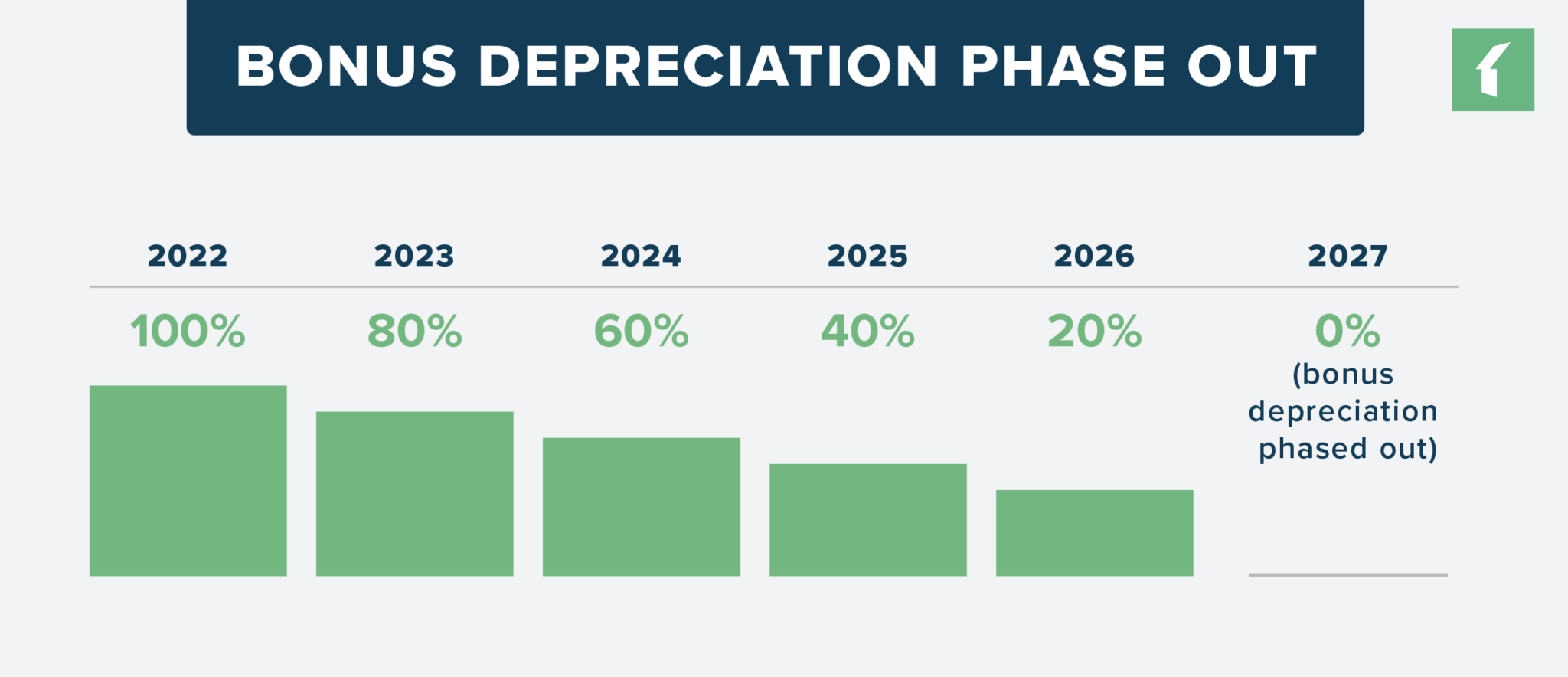

Is Bonus Depreciation Allowed In 2025. Irs regulations and guidance explain how to. Utilize both bonus depreciation and section 179 expensing to maximize tax savings.

At the heart of this legislative overhaul is the provision of 100% bonus depreciation, a move that has stirred discussions across the financial and business. For vehicles under 6,000 pounds in the tax year 2025, section 179 allows for a maximum deduction of $12,200 and bonus depreciation allows for a maximum of.

Bonus Depreciation Limits 2025 Dita Donella, Bonus depreciation allows businesses to deduct a large percentage of the cost of eligible purchases in the year when they acquire them, rather than depreciating.

Is Bonus Depreciation Allowed In 2025 Sibel Drusilla, Using bonus depreciation, you can deduct a certain percentage of the cost of an asset in the first year it was purchased, and the remaining cost can be deducted over.

2025 Bonus Depreciation For Vehicles Caryn Cthrine, New items purchased for a property can be deducted.

2025 Vehicle Bonus Depreciation Debi Mollie, The bonus depreciation rates are set for a significant shift as we transition from 2025 to 2025, a change that businesses need to prepare for in advance.

Bonus Depreciation 2025 Percentage On Rental Dehlia Layney, New items purchased for a property can be deducted.

2025 Bonus Depreciation For Vehicles Caryn Cthrine, Using bonus depreciation, you can deduct a certain percentage of the cost of an asset in the first year it was purchased, and the remaining cost can be deducted over.

Federal Bonus Depreciation 2025 Tana Franciska, The bonus depreciation rates are set for a significant shift as we transition from 2025 to 2025, a change that businesses need to prepare for in advance.

2025 Bonus Depreciation Rates Dannie Kristin, Bonus depreciation allows businesses to deduct a large percentage of the cost of eligible purchases in the year when they acquire them, rather than depreciating.

2025 Bonus Depreciation Percentage Table Debbie Kendra, While section 179 provides an upfront deduction up to a certain limit, bonus depreciation.

2025 Bonus Depreciation Rates Dannie Kristin, It begins to be phased out if 2025 qualified asset additions.